6 Steps to Managing Your Capital: VC for Female Founders (with Infographic)

Contributed by

Megan Darmody

November 11, 2020

Contributed by

Megan Darmody

November 11, 2020

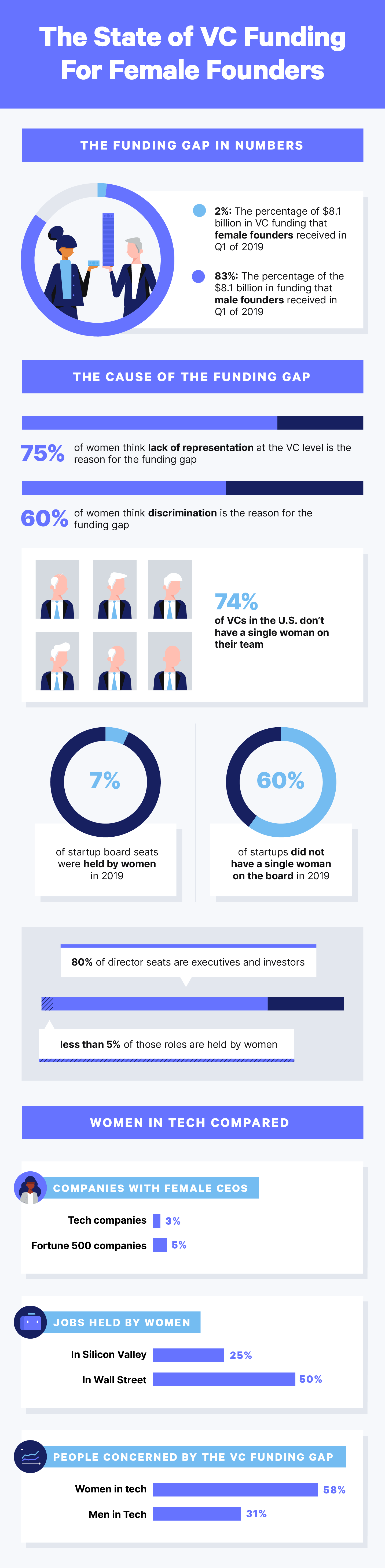

It comes as no surprise that female founders have struggled to earn a “seat at the table”.

Historically, women have had to work twice as hard to earn the same recognition and funding as their male counterparts. However, female-founded businesses deliver twice as much per dollar of funding than those that are male-founded. This is why powerful female entrepreneurs and founders are breaking ground across industries to prove they deserve at the very least equal opportunity and investment.

Although the venture capital world still has a long way to go, there have been positive strides. After all, the path to success is never easy, which is why female entrepreneurs lean on insights, guidance, and tangible advice from others. Below, we outline tips to thoughtfully manage your money, whether it’s from a VC firm or a friend’s early investment.

1. Have a Clear Grasp of Your Financials

This is so important, especially as you are just starting out. Numbers speak for themselves, and being able to speak to your finances and metrics will help you in many situations whether it’s in a partnership or VC meeting. Set regular check-ins to evaluate. A finance expert can be helpful to tap into if money talk isn’t a strength.

2. Scale Based on Demand

Rather than scale your business based on what’s expected, scale in response to demand. If you’re a new startup, you’re most likely still figuring out your market fit and target consumer. Take your time to understand all facets. As the business grows, issues can be much harder to fix. This may be why over 50% of startups fail. Funds for fueling the fire may no longer be available, so

3. Be Able to Negotiate

Negotiation is key when it comes to managing your capital. From brand partnerships to salary agreements or shareholder deals, it’s helpful to know how to negotiate responsibly. Prepare your team with the facts and data to find a mutually beneficial solution for all parties involved.

4. Hire Thoughtfully

The hiring process can be difficult. Avoid hiring prematurely, as you may be spending an excessive amount that can also lead you into over-hiring. Plus, the future is unpredictable. Find a balance by hiring in response to demand. Are your finances telling you it’s time to expand your production team? Hire so that investment drives directly back into the company.

5. Operate Remotely

Ask yourself if your startup still needs an office space to grow. Not only is rent costly, but more companies are shifting to full-time remote permanently. If your startup can work remotely, the money saved can be used in other areas that’ll benefit the business down the line.

6. Cut The “Fluff”

Business as we know it has changed tremendously due to the COVID-19 pandemic, and it’s the time to carefully evaluate all expenses. Cut the unnecessary fluff and think about what is a priority for your company. Whether it’s your office space, monthly happiness budgets, or something else, be mindful of where your money is going each month.

Running a business can be incredibly difficult and expensive — even without the uphill battle female founders often face. Every company is unique, so keep in mind what’s beneficial for your unique trajectory. For more on gender deal stages, data around capital, women-led VC funds, and tips for women to navigate the so-called “brotopia”, check out an in-depth guide on female founders and venture capital or view the infographic below.

The State of VC Funding For Female Founders Infographic

—

We would love you to be part of the #ConnectedWomen community! Join now to share, connect, work and learn – it’s free.

Sorry, the comment form is closed at this time.